how much taxes are taken out of a paycheck in ky

That changed in 2020. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122.

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Complete a Form 2040 Change of Address Notification and file it with KPPA.

. Total income taxes paid. Posted by 5 years ago. You pay the tax on only the first 147000 of your earnings in 2022.

In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000. For 2022 the limit for 401 k plans is 20500. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out.

Complete and file a Form 2040. Residents only need to pay federal tax. If youre a new employer youll pay a flat rate of 27.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Both employee and employer shares in paying these taxes each paying 765. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

Now you claim dependents on the new Form W-4. Kentucky Salary Paycheck Calculator. Workers in Kentucky who earn 8000 or more are in the 58 percent tax bracket of their wages in the form of state taxes.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Enter your name address Social Security number and tax.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This is the form that tells your employer how much of your money to withhold in taxes. Unless youre in construction then your rate is 10.

Bonus Checks After Taxes. 5 hours agoThe action by Beshear means Kentuckys gas tax will remain unchanged at 26 cents per gallon until at least mid-January 2023. The income tax brackets in the state of Kentucky are fairly narrow ranging from 2 percent for the lowest income workers to a high of 6 percent.

A 2020 or later W4 is required for all new employees. It also has a column for Medical HD to which I put 3760 and my employer puts 12251 per paycheck every other week. These are contributions that you make before any taxes are withheld from your paycheck.

672 More From GOBankingRates. Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates. Pro-abortion demonstrators outside Saint Pauls Roman Catholic Church in Brooklyn NY October 9 2021.

Kentucky Hourly Paycheck Calculator. Contact our office toll free at 1-800-928-4646 or locally at 502-696-8800. The average cost per gallon of gas in Kentucky sat at 455 Wednesday.

Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. Federal income taxes are paid in tiers. Speak with a KPPA counselor on the phone.

How Your Kentucky Paycheck Works. Switch to Kentucky hourly calculator. If you are an employee for two different employers you only claim dependents on one of your W-4s the one for the highest-paying of the two jobs.

For a single filer the first 9875 you earn is taxed at 10. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

How much you pay in federal income taxes depends on the information you filled out on your Form W-4. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis.

You can easily update your address on our Self Service website. Use this calculator to help determine your net take-home pay from a company bonus. Log in to Self Service.

The next 30249 you earn--the amount from 9876 to 40125-. How much taxes are taken out of a paycheck in ky Tuesday May 31 2022 Edit. The wage base is 11100 for 2022 and rates range from 05 to 95.

Form W-4 is available on the IRS website. But the income threshold for the low levels of taxation is very low. For self-employed individuals they have to pay the full percentage themselves.

How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. 2813 Amount taken out of an average biweekly paycheck. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator.

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. 215 Amount taken out of an average biweekly paycheck. Total income taxes paid.

Therefore you need to fill out a new one whenever you start a new job or if you need to make any changes during the year. Use tab to go to the next focusable element. Its important to note that there are limits to the pre-tax contribution amounts.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. How much do you make after taxes in Texas. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Any income exceeding that amount will not be taxed. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

Heres how to complete the steps that apply to your situation. For a single filer who earns 59000 per annual the total take home pay is 48519. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. Our calculator has been specially developed in order to provide the users of the calculator with not only.

Payroll Software Solution For Kentucky Small Business

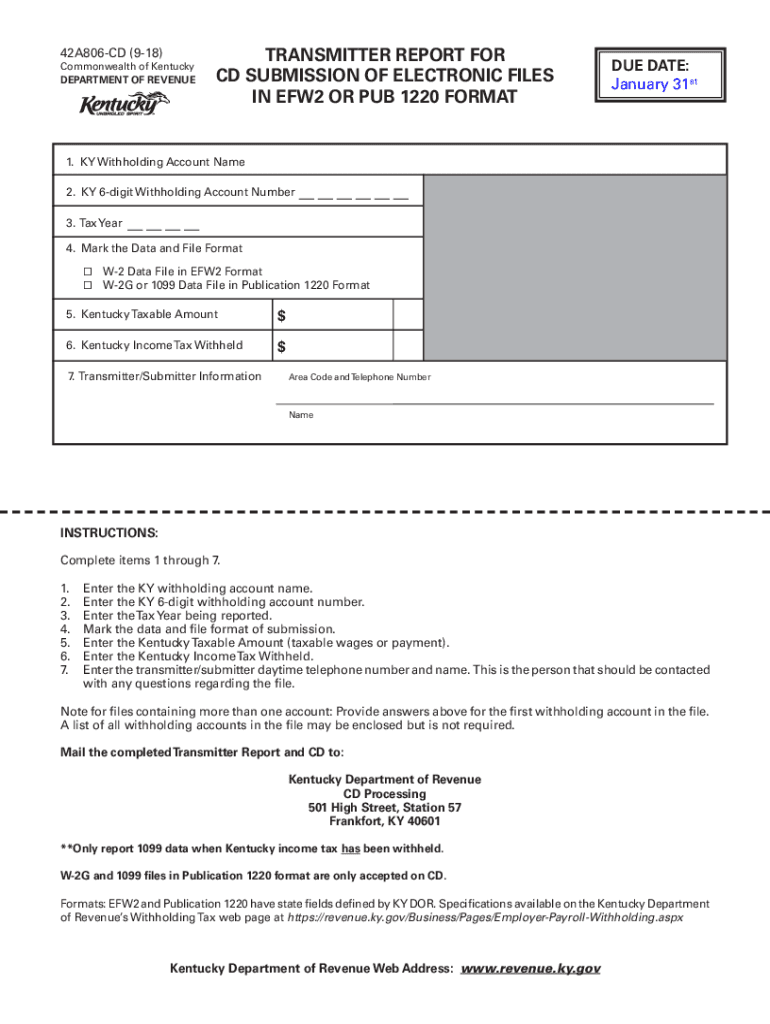

Ky Dor 42a806 2018 2022 Fill Out Tax Template Online Us Legal Forms

Breaking Down Paystub Deduction Codes Paystubcreator

Kentucky Paycheck Calculator Smartasset

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 Federal State Payroll Tax Rates For Employers

Payroll Software Solution For Kentucky Small Business

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Tax Withholding For Pensions And Social Security Sensible Money

Paycheck Calculator Kentucky Ky Hourly Salary

I Make 800 A Week How Much Will That Be After Taxes Quora

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Kentucky Income Tax Calculator Smartasset

Peoplesoft Payroll For North America 9 1 Peoplebook

Kentucky Income Tax Calculator Smartasset

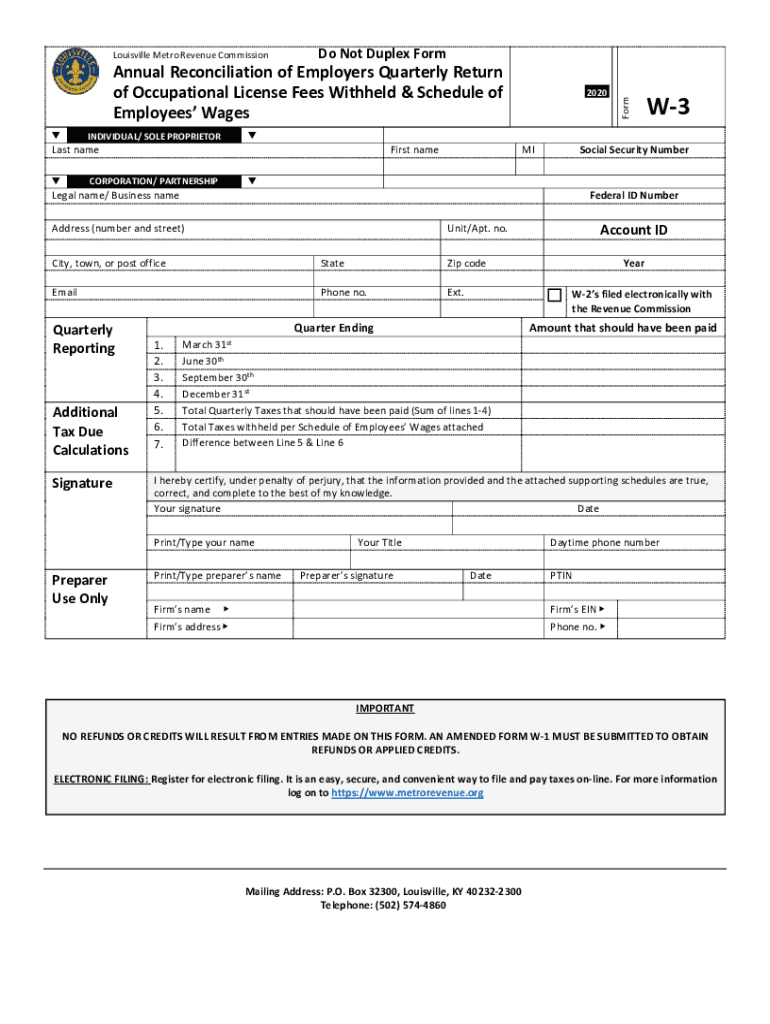

Ky W 3 Louisville 2020 2022 Fill Out Tax Template Online Us Legal Forms

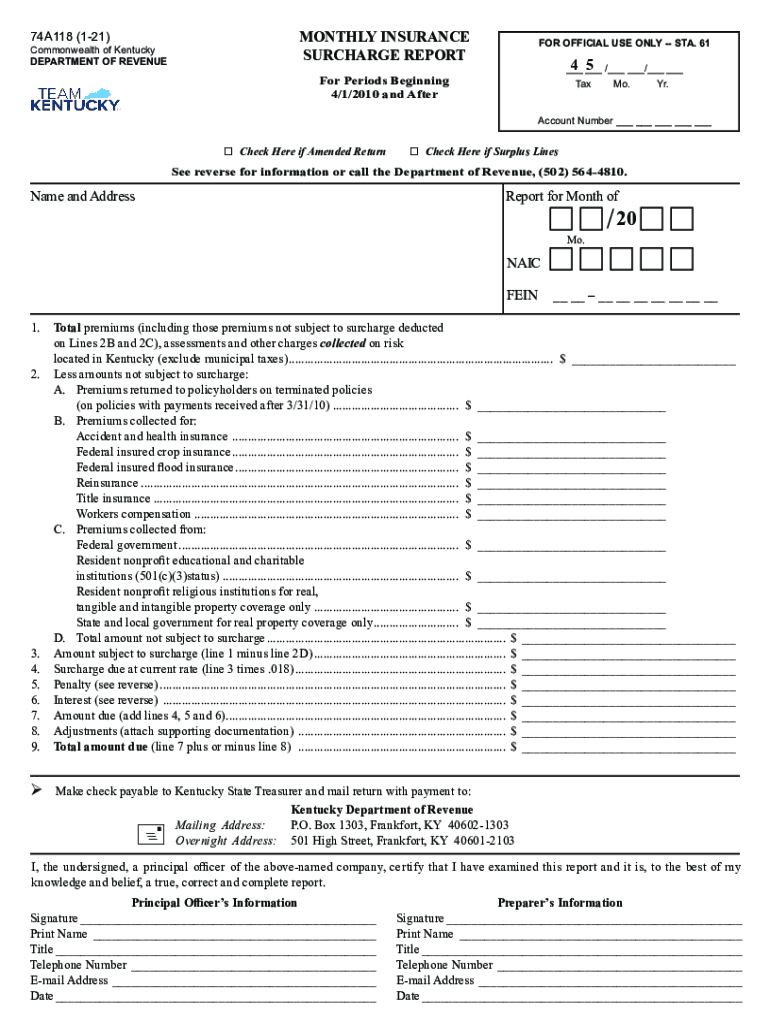

Ky 74a118 2021 2022 Fill Out Tax Template Online Us Legal Forms

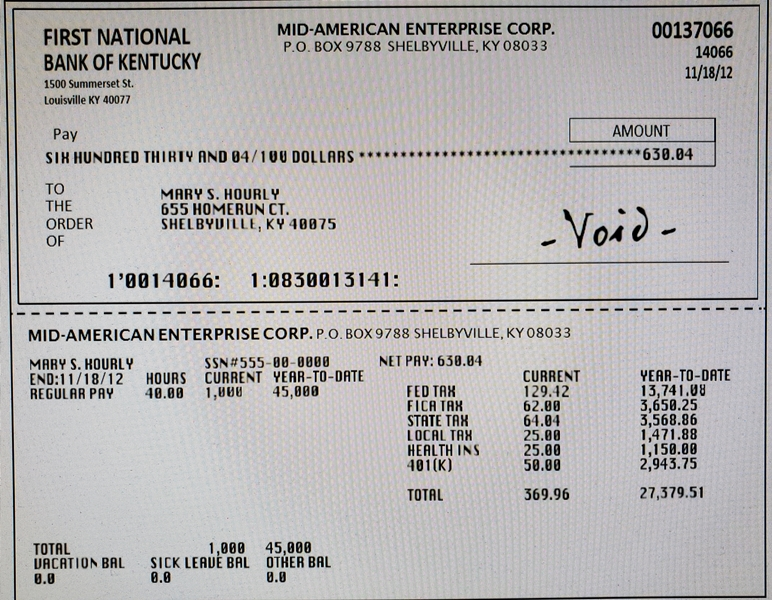

Solved Look At The Check Below And Answer The Following Chegg Com